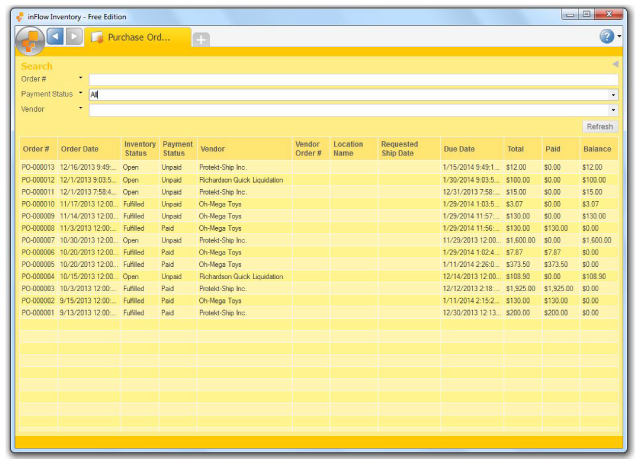

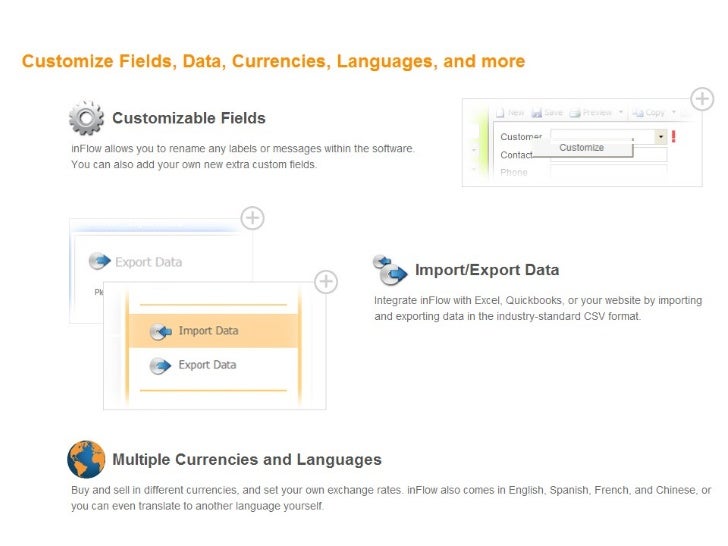

Inflow Inventory Standard Edition

Corporate Finance 9th edition Solutions Manual Solutions Manual Corporate Finance Ross Westerfield and Jaffe 9th edition. Unformatted text preview Corporate Finance 9th edition Solutions Manual Solutions Manual. Corporate Finance. Ross, Westerfield, and Jaffe. Updated 0. 32. 22. Corporate Finance 9th edition Solutions Manual CHAPTER 1. INTRODUCTION TO CORPORATE. Answers to Concept Questions. In the corporate form of ownership, the shareholders are the owners of the firm. The shareholders. This separation of. Management may act in its own or someone elses best interests, rather than those of the. If such events occur, they may contradict the goal of maximizing the share price of the. Such organizations frequently pursue social or political missions, so many different goals are. One goal that is often cited is revenue minimization i. Parallel To Serial Converter Verilog Code For And Gate. A better approach might be to observe that. Thus, one answer is that the appropriate goal is to. Presumably, the current stock value reflects the risk, timing, and magnitude of all future cash flows. If this is correct, then the statement is false. An argument can be made either way. At the one extreme, we could argue that in a market economy. Since 2010, the South Luzon Expressway network cuts southwards from the Manila up to the provinces of Laguna, Cavite, and Batangas. Future plans call for the. NdBOOiMN4mc/maxresdefault.jpg' alt='Inflow Inventory Standard Edition' title='Inflow Inventory Standard Edition' /> Review of inFlow Inventory Software system overview, features, price and cost information. Get free demos and compare to similar programs. FOREWORD TO THE FIRST EDITION by the Secretary General of IOSCO In recent years much has been written about International Financial Reporting Standards IFRS so it. No more missed important software updates UpdateStar 11 lets you stay up to date and secure with the software on your computer. Issues. Pulp and paper mills contribute to air, water and land pollution and discarded paper and paperboard make up roughly 26 of solid municipal solid waste in. A20J0GURwE/maxresdefault.jpg' alt='Inflow Inventory Standard Edition' title='Inflow Inventory Standard Edition' />

Review of inFlow Inventory Software system overview, features, price and cost information. Get free demos and compare to similar programs. FOREWORD TO THE FIRST EDITION by the Secretary General of IOSCO In recent years much has been written about International Financial Reporting Standards IFRS so it. No more missed important software updates UpdateStar 11 lets you stay up to date and secure with the software on your computer. Issues. Pulp and paper mills contribute to air, water and land pollution and discarded paper and paperboard make up roughly 26 of solid municipal solid waste in. A20J0GURwE/maxresdefault.jpg' alt='Inflow Inventory Standard Edition' title='Inflow Inventory Standard Edition' />

There is thus an optimal level of, for example, ethical andor illegal. At the other extreme, we. A classic and highly relevant thought question that illustrates this debate goes something. A firm has estimated that the cost of improving the safety of one of its products is 3. However, the firm believes that improving the safety of the product will only save 2. What should the firm do 5. The goal will be the same, but the best course of action toward that goal may be different because of. The goal of management should be to maximize the share price for the current shareholders. If. management believes that it can improve the profitability of the firm so that the share price will. If management believes that. However, if the current management cannot increase. Since current managers often lose. Corporate Finance 9th edition Solutions Manual 7. We would expect agency problems to be less severe in other countries, primarily due to the relatively. Fewer individual owners should reduce the number of. The high percentage of institutional ownership might. In addition, institutions may be better able to implement effective monitoring mechanisms. The increase in institutional ownership of stock in the United States and the growing activism of. Domestic Violence Batterers Treatment Program here. U. S. corporations and. However, this may not always be the case. If the. managers of the mutual fund or pension plan are not concerned with the interests of the investors, the. How much is too much Who is worth more, Ray Irani or Tiger WoodsThe simplest answer is that. Executive compensation is the. The same is true for athletes and performers. Having said that, one. A primary reason executive compensation has. Such movement is obviously consistent with the attempt to better align stockholder and management. In recent years, stock prices have soared, so management has cleaned up. It is sometimes. argued that much of this reward is simply due to rising stock prices in general, not managerial. Perhaps in the future, executive compensation will be designed to reward only. Maximizing the current share price is the same as maximizing the future share price at any future. The value of a share of stock depends on all of the future cash flows of company. Another. way to look at this is that, barring large cash payments to shareholders, the expected price of the. Who would buy a stock for 1. Corporate Finance 9th edition Solutions Manual CHAPTER 2. ACCOUNTING STATEMENTS, TAXES. Answers to Concepts Review and Critical Thinking Questions. True. Every asset can be converted to cash at some price. However, when we are referring to a liquid. The recognition and matching principles in financial accounting call for revenues, and the costs. Note that this way is not. The bottom line number shows the change in the cash balance on the balance sheet. As such, it is not. The major difference is the treatment of interest expense. The accounting statement of cash flows. The logic of the accounting statement of cash flows is that since interest appears on the. In reality. interest is a financing expense, which results from the companys choice of debt and equity. We will. have more to say about this in a later chapter. When comparing the two cash flow statements, the. Market values can never be negative. Imagine a share of stock selling for 2. This would mean. that if you placed an order for 1. How many shares do you want to buy More generally, because of corporate and individual. For a successful company that is rapidly expanding, for example, capital outlays will be large. In general, what matters is whether the money is. Its probably not a good sign for an established company to have negative cash flow from. Corporate Finance 9th edition Solutions Manual 8. For example, if a company were to become more efficient in inventory management, the amount of. The same might be true if the company becomes better at collecting. In general, anything that leads to a decline in ending NWC relative to beginning. Negative net capital spending would mean more long lived assets were. If a company raises more money from selling stock than it pays in dividends in a particular period. If a company borrows more than it pays in interest and. The adjustments discussed were purely accounting changes they had no cash flow or market value. Solutions to Questions and Problems. NOTE All end of chapter problems were solved using a spreadsheet. Many problems require multiple. Due to space and readability constraints, when these intermediate steps are included in this. However, the final answer for each problem is. Tell Me More V10 English 10 Levels Dvd there. To find owners equity, we must construct a balance sheet as follows. TA Balance Sheet. We know that total liabilities and owners equity TL OE must equal total assets of 3. We. also know that TL OE is equal to current liabilities plus long term debt plus owners equity, so. OE 3. 1,3. 00 1. NWC CA CL 5,3. The income statement for the company is. Income Statement. Net income 4. 93,0. Corporate Finance 9th edition Solutions Manual One equation for net income is. Net income Dividends Addition to retained earnings. Rearranging, we get. Addition to retained earnings Net income Dividends. Addition to retained earnings 1. Addition to retained earnings 9. To find the book value of current assets, we use NWC CA CL. Rearranging to solve for current. CA NWC CL 8. The market value of current assets and net fixed assets is given, so. Book value NFA 5,0. Book value assets 7,9. Market value CA. Market value NFA 6,3. Market value assets 9,1. Taxes 0. 1. 55. K 0. K 0. K 0. 3. 92. 46. K 1. 00. K. Taxes 7. The average tax rate is the total tax paid divided by net income, so. Average tax rate 7. Average tax rate 3. The marginal tax rate is the tax rate on the next 1 of earnings, so the marginal tax rate 3. To calculate OCF, we first need the income statement. Income Statement. Net income 1. 4,9. OCF EBIT Depreciation Taxes. OCF 7,8. 00 1,3. Net capital spending NFAend NFAbeg Depreciation. Net capital spending 1,7. Net capital spending 3. Corporate Finance 9th edition Solutions Manual 7. The long term debt account will increase by 1. Since the company sold 1. The capital surplus account will increase by 3. Since the company had a net income of 9 million.

There is thus an optimal level of, for example, ethical andor illegal. At the other extreme, we. A classic and highly relevant thought question that illustrates this debate goes something. A firm has estimated that the cost of improving the safety of one of its products is 3. However, the firm believes that improving the safety of the product will only save 2. What should the firm do 5. The goal will be the same, but the best course of action toward that goal may be different because of. The goal of management should be to maximize the share price for the current shareholders. If. management believes that it can improve the profitability of the firm so that the share price will. If management believes that. However, if the current management cannot increase. Since current managers often lose. Corporate Finance 9th edition Solutions Manual 7. We would expect agency problems to be less severe in other countries, primarily due to the relatively. Fewer individual owners should reduce the number of. The high percentage of institutional ownership might. In addition, institutions may be better able to implement effective monitoring mechanisms. The increase in institutional ownership of stock in the United States and the growing activism of. Domestic Violence Batterers Treatment Program here. U. S. corporations and. However, this may not always be the case. If the. managers of the mutual fund or pension plan are not concerned with the interests of the investors, the. How much is too much Who is worth more, Ray Irani or Tiger WoodsThe simplest answer is that. Executive compensation is the. The same is true for athletes and performers. Having said that, one. A primary reason executive compensation has. Such movement is obviously consistent with the attempt to better align stockholder and management. In recent years, stock prices have soared, so management has cleaned up. It is sometimes. argued that much of this reward is simply due to rising stock prices in general, not managerial. Perhaps in the future, executive compensation will be designed to reward only. Maximizing the current share price is the same as maximizing the future share price at any future. The value of a share of stock depends on all of the future cash flows of company. Another. way to look at this is that, barring large cash payments to shareholders, the expected price of the. Who would buy a stock for 1. Corporate Finance 9th edition Solutions Manual CHAPTER 2. ACCOUNTING STATEMENTS, TAXES. Answers to Concepts Review and Critical Thinking Questions. True. Every asset can be converted to cash at some price. However, when we are referring to a liquid. The recognition and matching principles in financial accounting call for revenues, and the costs. Note that this way is not. The bottom line number shows the change in the cash balance on the balance sheet. As such, it is not. The major difference is the treatment of interest expense. The accounting statement of cash flows. The logic of the accounting statement of cash flows is that since interest appears on the. In reality. interest is a financing expense, which results from the companys choice of debt and equity. We will. have more to say about this in a later chapter. When comparing the two cash flow statements, the. Market values can never be negative. Imagine a share of stock selling for 2. This would mean. that if you placed an order for 1. How many shares do you want to buy More generally, because of corporate and individual. For a successful company that is rapidly expanding, for example, capital outlays will be large. In general, what matters is whether the money is. Its probably not a good sign for an established company to have negative cash flow from. Corporate Finance 9th edition Solutions Manual 8. For example, if a company were to become more efficient in inventory management, the amount of. The same might be true if the company becomes better at collecting. In general, anything that leads to a decline in ending NWC relative to beginning. Negative net capital spending would mean more long lived assets were. If a company raises more money from selling stock than it pays in dividends in a particular period. If a company borrows more than it pays in interest and. The adjustments discussed were purely accounting changes they had no cash flow or market value. Solutions to Questions and Problems. NOTE All end of chapter problems were solved using a spreadsheet. Many problems require multiple. Due to space and readability constraints, when these intermediate steps are included in this. However, the final answer for each problem is. Tell Me More V10 English 10 Levels Dvd there. To find owners equity, we must construct a balance sheet as follows. TA Balance Sheet. We know that total liabilities and owners equity TL OE must equal total assets of 3. We. also know that TL OE is equal to current liabilities plus long term debt plus owners equity, so. OE 3. 1,3. 00 1. NWC CA CL 5,3. The income statement for the company is. Income Statement. Net income 4. 93,0. Corporate Finance 9th edition Solutions Manual One equation for net income is. Net income Dividends Addition to retained earnings. Rearranging, we get. Addition to retained earnings Net income Dividends. Addition to retained earnings 1. Addition to retained earnings 9. To find the book value of current assets, we use NWC CA CL. Rearranging to solve for current. CA NWC CL 8. The market value of current assets and net fixed assets is given, so. Book value NFA 5,0. Book value assets 7,9. Market value CA. Market value NFA 6,3. Market value assets 9,1. Taxes 0. 1. 55. K 0. K 0. K 0. 3. 92. 46. K 1. 00. K. Taxes 7. The average tax rate is the total tax paid divided by net income, so. Average tax rate 7. Average tax rate 3. The marginal tax rate is the tax rate on the next 1 of earnings, so the marginal tax rate 3. To calculate OCF, we first need the income statement. Income Statement. Net income 1. 4,9. OCF EBIT Depreciation Taxes. OCF 7,8. 00 1,3. Net capital spending NFAend NFAbeg Depreciation. Net capital spending 1,7. Net capital spending 3. Corporate Finance 9th edition Solutions Manual 7. The long term debt account will increase by 1. Since the company sold 1. The capital surplus account will increase by 3. Since the company had a net income of 9 million.